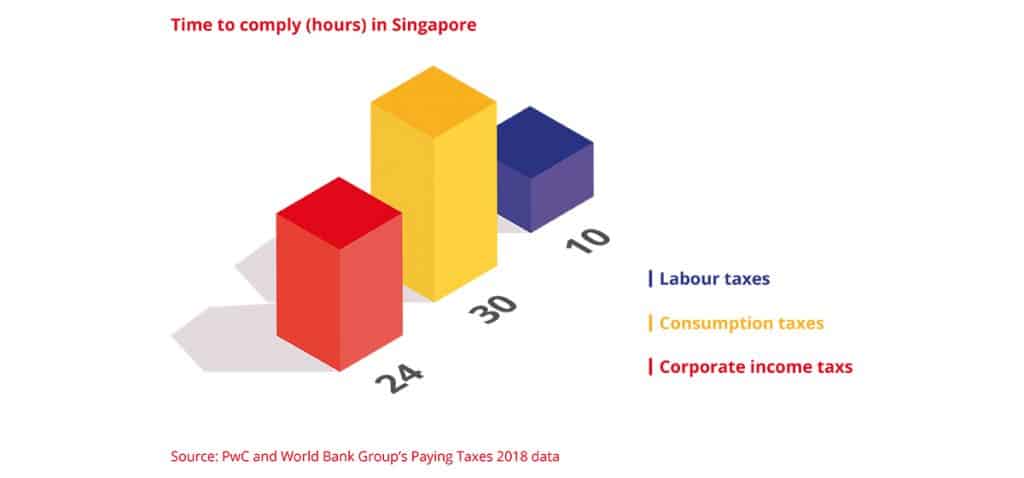

Why a robust payroll software can keep your business from tripping up during tax season.

Tax season needn’t be scary. Staying compliant with laws and regulations also shouldn’t occupy weeks and months of a business’s time.

In fact, businesses that rely on digital tools significantly alleviate their stress.

A 2019 Singapore study that tracked the digital adoption and performance of 1,150 businesses (83% of them SMEs) noted:

- From 2014 to 2016, the adoption of digital tools — such as Software-as-a-Service (SaaS) and data analytics — alone gave SMEs an edge,

- SMEs experienced a statistically significant increase in value-add (26%) and productivity (17%).

Digital adoption also positions them to respond to change — fast.

Administrative services firm TMF Group’s 2019 report on key accounting and tax practices and trends worldwide has also highlighted that digital transformation would benefit Singapore businesses’ accounting and tax practices.

Ms Kim Leng Siaw, managing director of Singapore at TMF, outlines just why this is so crucial: “Business expansion, especially to new territories, is challenging and companies must be able to face the realities of their new markets, which may require a shift from routine business practices. This includes adapting to accounting and tax processes, which are constantly evolving to better suit the business landscape.”

Even so, issues of compliance plague more than a third of executives, said a 2019 study by payment solutions provider Stripe. In addition to duress, their businesses park between 5.9% and 37.8% of their net profit each year to keep in-line with international laws.

By contrast, the same report, which surveyed decision-makers running online businesses across 15 global markets, found the top factor for surmounting obstacles as this: adoption of accessible digital tools. Up to 68% of respondents reported that they relied on digital tools such as SaaS to better help their businesses expand globally.

Streamlining traditional HR processes through SaaS

Good payroll software eases stress related to auditing — period. It automates the recording of monthly payroll processing and tax submissions for the full annual year by extracting data from payroll records to prepare annual tax submission documents. For added convenience, bank files and CPF files can also be downloaded as soon as payroll is approved. This seamless service reduces the need for human intervention and ensures compliance, giving business owners peace of mind.

Compare this seamless and automated process to what most businesses do: manually transferring raw data from accounting systems and reconciling them in spreadsheets, line by line.

Moreover, such manual methods invite errors. Even if made without any intention to evade or misrepresent regulatory payments or taxes, these errors can result in the following penalties under Singapore’s Income Tax Act:

- a penalty up to 200% of the amount of tax undercharged;

- a fine of up to $5,000; and/or

- imprisonment of up to three years.

By putting payroll software in place at the start of the financial year, businesses spare themselves from spending weeks on laborious and manual tax-filing for compliance purposes.

What’s keeping SMEs from their digital transformation?

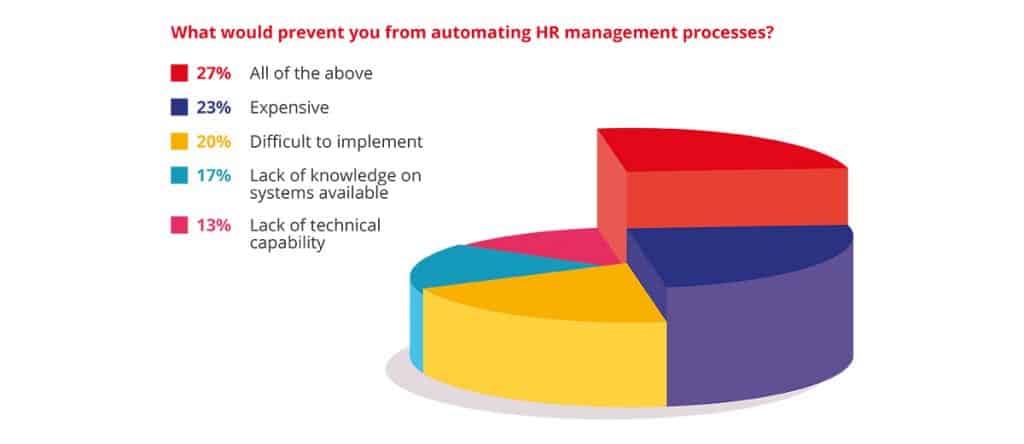

SMEs are still hesitant about adopting digital tools for their HR management for two main reasons: cost of use, and ease of adoption.

A HReasily survey of 467 international delegates who attended the recent RISE 2019 conference in Hong Kong found that the top individual factor hindering them from automating HR management processes was cost of use at 23%.

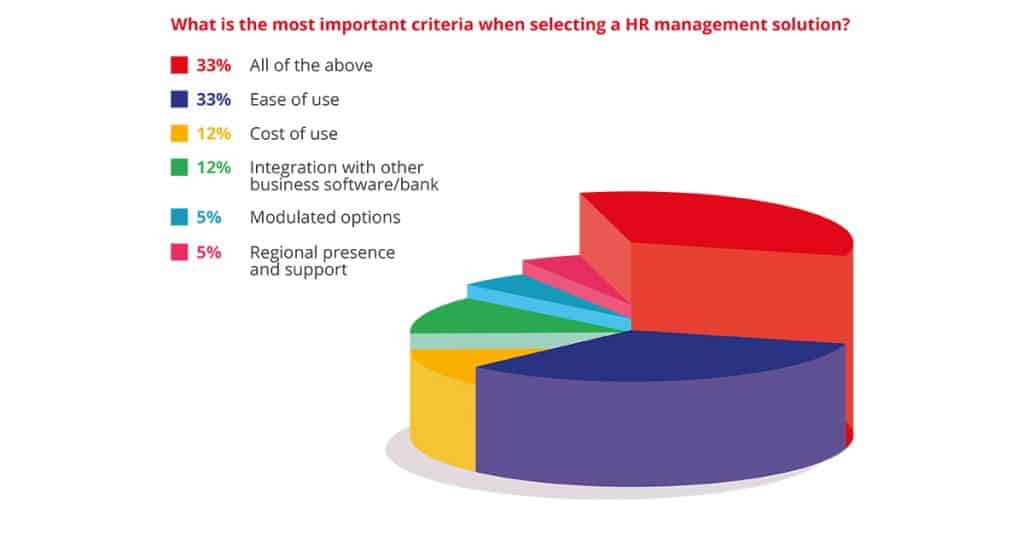

What’s interesting to note too is that the most important individual criteria when selecting HR management solutions was not cost of use (12%) but rather ease of use (33%).

The survey results show that what has kept SME bosses from the very digital transformation their businesses need to succeed is the enduring perception that automation is not only expensive, it might also be too complicated to implement seamlessly.

That’s where HReasily comes in.

The HReasily Solution

Responding to these two key pain points of cost and ease of use, HReasily has built its solutions to help executives stay focused on developing their core business offerings and keep on top of regulations as their businesses grow without blowing a hole through their compliance budgets.

“By streamlining payroll processing, leave and claims management while remaining affordable, HReasily helps businesses boost productivity and save on costs,” explains Ms Cheryl Pay, the firm’s business analyst.

HReasily’s SaaS business is built to reduce the pressure that compliance brings on managers and bottom lines by focusing on the needs of those who need this service the most — companies with headcount of not more than 200.

“When I was running my first startup in Singapore, I had to do a lot of the manual processes myself. I felt the pain and the drain of it,” recollects Mr Pascal Henry, CEO and cofounder of HReasily in a Forbes article on HReasily’s unique selling proposition. Recalling a familiar pain point still impacting businesses today, he notes, “It was taking up a lot of my time and energy, when I should have been focusing on building my business.”

HReasily offers built-in components which fully comply with the 22 recommended controls set out by the Inland Revenue Authority of Singapore (IRAS). In fact, IRAS itself rates HReasily’s payroll software an “A” in the category of “Software Compliance to Controls” — a distinction only the top 19% of 134 payroll vendors in Singapore received in 2019. HReasily’s integrated payroll solutions are also compliant in Malaysia, Thailand and Hong Kong.

Even better, HReasily’s solutions are now more affordable

Eligible Singapore SMEs can tap on the Productivity Solutions Grant (PSG) for a government subsidy of up to 70% on digital productivity solutions. This month, HReasily qualified to become an approved vendor for the PSG in Singapore: being a pre-qualified digital human-resource solution means expedited approval for SMEs who apply for the grant to utilise HReasily’s solutions.

With PSG, Singapore SMEs can also adopt and implement HReasily’s packages without major budgetary disruptions. This significantly lowers the cost of adopting and implementing needful HR tech to handle the mundane and recurring aspects of managing business operations. All this aligns with HReasily’s mission: To build digitally empowered professionals, by changing the way they work.

To find out how you can reap the benefits from PSG-approved vendors such as HReasily, please contact our sales team.