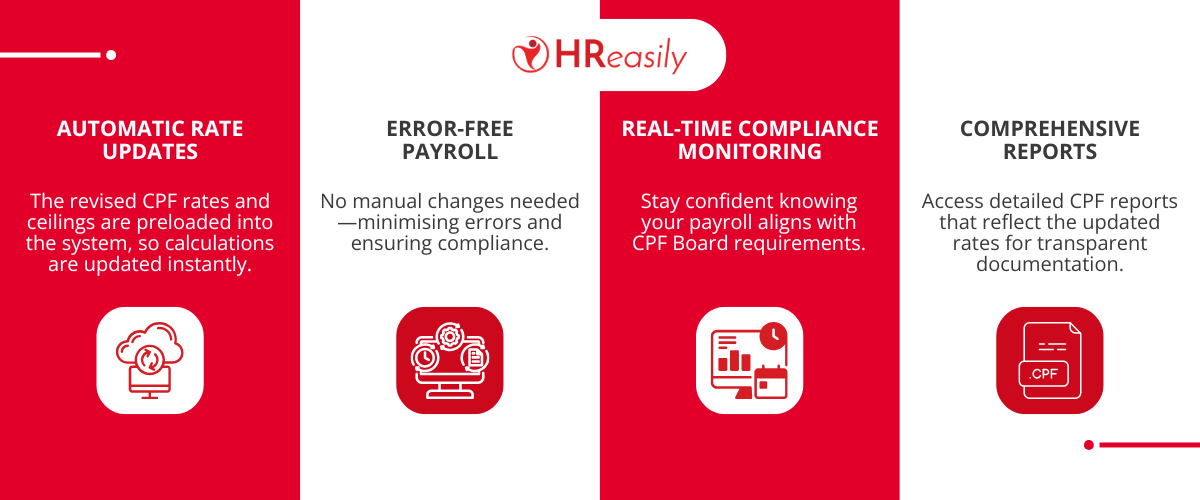

Ensuring compliance with statutory regulations is a key focus at HReasily. We are excited to share that our system is fully equipped to support the upcoming revisions to CPF contribution rates and Additional Wage Ceiling adjustments, effective in 2025 and 2026.

What’s Changing?

The CPF contribution rates for employees and employers will see gradual adjustments in 2025 and 2026. These changes are part of Singapore’s ongoing efforts to enhance retirement adequacy. Additionally, updates to the Additional Wage Ceiling will affect the calculation of CPF contributions for employees earning above the Ordinary Wage Ceiling.

How Does HReasily Help?

HReasily ensures that your payroll processes remain seamless and compliant with the latest statutory requirements. Here’s how our system supports you:

Why Choose HReasily?

As a trusted payroll and HR solution, HReasily adapts to regulatory changes swiftly, giving businesses peace of mind. With a user-friendly interface and reliable automation, we help businesses of all sizes focus on growth while handling compliance effortlessly.

Stay Ahead with CPF Compliance Using HReasily

Ensure your payroll is ready for the upcoming changes with HReasily’s advanced capabilities. Automatically adapt to revised CPF contribution rates and Additional Wage Ceiling updates for 2025 and 2026. Generate error-free reports and manage your payroll effortlessly while staying compliant with statutory requirements. Save time, enhance accuracy, and enjoy peace of mind with HReasily. Get started with HReasily today!

Need assistance? We’re here for you. Email us at [email protected] or book a demo session today. [BOOK A DEMO]

Our team is here to help you navigate these new features, ensuring a smooth implementation that fits your business needs. Let us support you in optimising payroll management and gaining valuable insights. Bookmark our In the News and Product Updates pages, where you can stay informed on all new HReasily product features and enhancements.